Trading in financial markets has always been a dynamic and challenging endeavor. With rapid advancements in technology, the landscape of trading has evolved, and traders now have access to powerful tools that can enhance their trading strategies.

One such tool that has been gaining significant attention is trading bots.

In this article, we delve into the world of trading bots and how they can be the secret weapon every trader needs for success.

How Trading Bots Work

Trading bots utilize sophisticated algorithms and machine learning techniques to analyze vast amounts of historical and real-time market data.

They can interpret technical indicators, chart patterns, and news events to make informed trading decisions. Depending on the trader’s strategy, these bots can execute trades on a variety of financial instruments, including stocks, forex, cryptocurrencies, and commodities.

The Rise of Trading Bots

Trading bots are automated software applications that execute trading strategies on behalf of traders.These bots are designed to analyze market data, identify trading opportunities, and execute trades with speed and precision.

With their ability to operate 24/7 without the need for human intervention, trading bots eliminate emotional biases and fatigue that often hinder human traders.

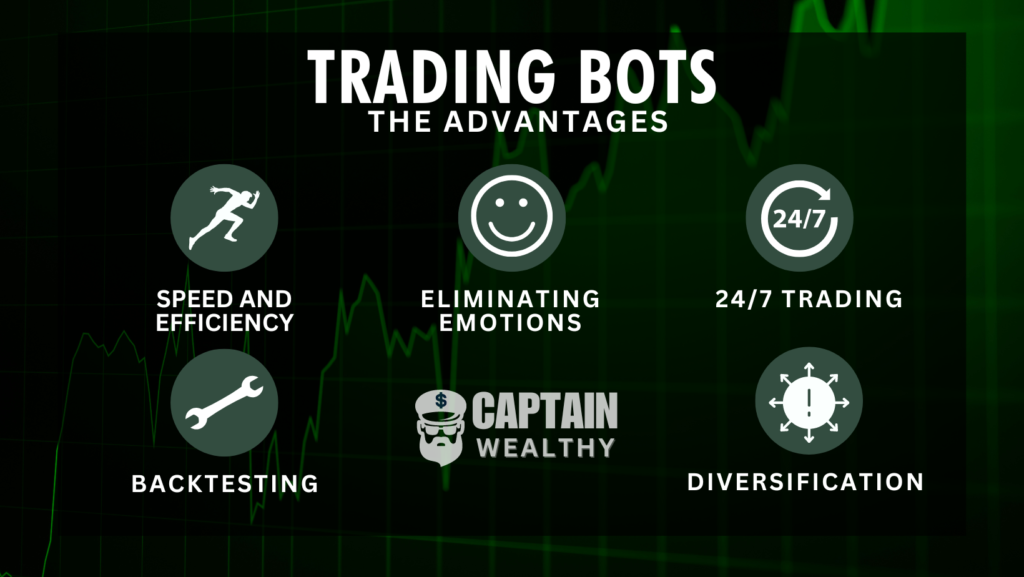

Main Advantages of Trading Bots

1. Speed and Efficiency

Trading bots can execute trades in a matter of milliseconds, which is crucial in fast-moving markets. They can instantly respond to market changes and execute trades at the best available prices, maximizing profit potential.

2. Eliminating Emotions

Emotions can cloud judgment and lead to impulsive trading decisions. Trading bots operate based on predefined rules, removing emotions from the equation and ensuring consistent execution of the trading strategy.

3. 24/7 Trading

Unlike human traders, who need rest, trading bots can operate around the clock. This allows traders to take advantage of opportunities in different time zones and market conditions.

4. Backtesting and Optimization

Trading bots often come with backtesting capabilities, allowing traders to test their strategies using historical data. This feature helps traders refine their strategies and assess their performance before deploying them in live trading.

5. Diversification

Trading bots can simultaneously execute multiple trading strategies across different assets. This diversification reduces risk and provides opportunities to profit in various market conditions.

Selecting the Right Trading Bot

With a wide range of trading bots available in the market, choosing the right one can be overwhelming.

Traders must consider factors such as the bot’s track record, supported assets, customization options, and pricing. Additionally, it’s essential to opt for reputable and secure trading bot providers to safeguard funds and data.

My Favorite Bot Option (Beginner Friendly)

CoinRule

Coinrule is an automated trading platform designed for cryptocurrency traders. It allows users to create and execute trading strategies without the need for coding skills. With its user-friendly interface, traders can easily set up rule-based strategies based on technical indicators, market conditions, and price levels.

Pros

- No trading fees (charges a flat monthly rate)

- Free account to paper trade, backtest and make a limited amount of trades

- Doesn’t access private keys

- Mobile app for on-the-go trading

Cons

- Trades only on centralized exchanges.

- No connections with Gemini

My Personal Opinion: Great tool. You can design your own rules to trade crypto without being a coder. So you can DCA or buy the dip, grid trading or trend following, whatever is your style and depending on market conditions. They already have a large set of crypto trading rules templates but you can be creative and develop your own rules. It is very intuitive. The community and Coinrule support are very active on telegram.

Risk Management and Caution

While trading bots offer numerous benefits, it’s crucial to exercise caution and implement proper risk management strategies.

Traders should start with small trading volumes, use secure exchanges, and avoid blindly following unproven strategies.

The Future of Trading

As technology continues to evolve, trading bots are likely to become even more sophisticated and accessible. They may incorporate artificial intelligence and machine learning capabilities, further enhancing their performance and adaptability.

In conclusion, trading bots have emerged as a powerful tool for traders seeking to optimize their trading strategies.

With their speed, efficiency, and ability to eliminate emotions, trading bots can be the secret weapon every trader needs for success in the dynamic world of financial markets.