Your financial health is significantly influenced by your credit score. It serves as a quick indicator to lenders of how responsibly you handle credit. A higher score makes it easier for you to be approved for new loans or credit lines. Not only that, but having a high credit score can also offer you access to the most favorable interest rates when you borrow.

Improving your credit score is achievable with some quick and easy steps. Although it may take a few months to witness any significant improvement in your score, you can begin making progress towards a better score in just a few hours.

Understanding your credit score

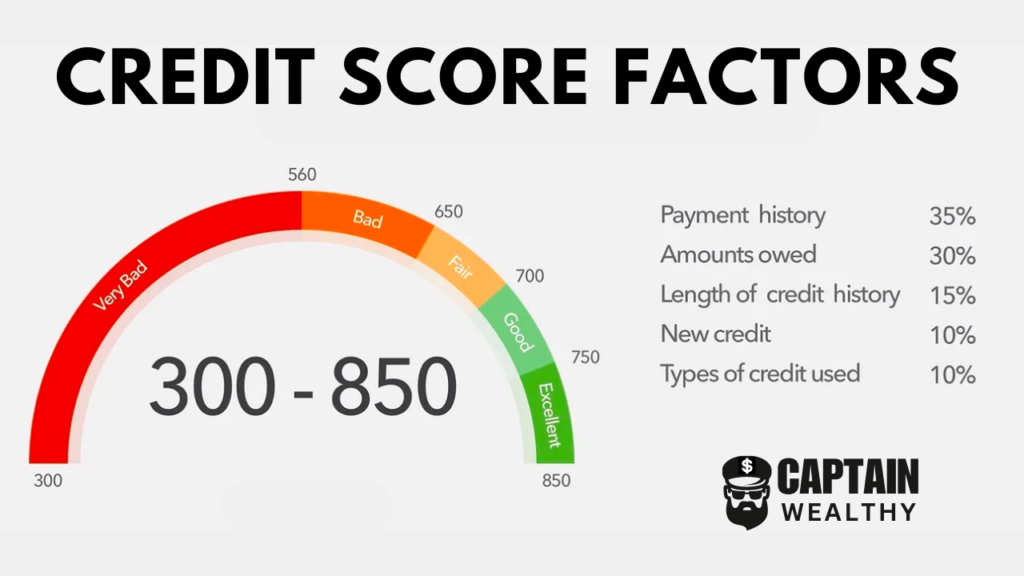

To begin with, it’s important to understand your credit score. Your credit score is essentially a numerical value ranging from 300 to 900 that reflects your previous credit usage patterns and keeps evolving based on your current credit activity.

So how can you get credit scores? Here are a few ways:

Method 1: Get your credit score

It’s a good idea to review your credit score periodically to keep track of your financial health. Luckily, many financial institutions now provide credit scores to their customers. You can easily find your credit score by checking your credit card, loan or bank statements.

Alternatively, most companies also offer online access to your score by simply logging into your account. By regularly monitoring your credit score, you can stay informed and make informed financial decisions.

Method 2: Purchase your credit score

Purchase credit scores directly from one of the three major credit bureaus or other provider, such as FICO.

You can utilize a credit score service or opt for a free credit scoring website. Certain websites offer the convenience of a credit score report at no cost to the user. Meanwhile, other sites may furnish credit scores to credit monitoring clients who pay a monthly subscription fee.

It is highly recommended to not only monitor your credit scores but also to regularly review your credit reports to verify the accuracy and completeness of the information provided.

Once you know your score, you can see where you stand.

What’s a Good Credit Score?

A good credit score would be anywhere from 660 and up

- 300 to 560: Poor

- 561 to 659: Fair

- 660 to 724: Good

- 725 to 759: Very good

- 760 to 900: Excellent

In order to increase your chances of being approved for credit cards, mortgages, or car loans, it is advisable to have a credit score of at least 660, which is considered “good” territory. However, having a higher credit score is even more advantageous, as it presents you as a more trustworthy borrower.

A lot of individuals strive to achieve a credit score of 760 or higher as it is deemed as “excellent”. This is because having an excellent credit score can often lead to better interest rates when taking out a loan.

Why Does a Good Credit Score Matter?

Your credit score is a reflection of your debt management skills. The better your score, the more trustworthy you seem to lenders.

When it comes to the FICO model, a score of 850 is deemed flawless, which is the highest possible score.

What does a high credit score get you?

One of the easiest ways to obtain better loan conditions and faster approval is by having a good or excellent credit score. This can potentially save individuals hundreds of thousands of dollars throughout their lives.

With a stellar credit score, one can secure lower interest rates on mortgages, auto loans, and any type of financing. Essentially, having a good credit score can make a significant difference in one’s financial well-being.

5 Ways to Increase Your Credit Score Quickly

Now that we’ve covered what credit scores mean, here are some ways to improve your credit.

- Review Your Credit Reports

- Join a Credit Builder Program

- Pay down your revolving credit balances

- Request a credit limit increase

- Apply for a new credit card

Improving your credit score and building good credit requires taking a series of steps, both short-term and long-term. Let’s take a closer look at what each of these steps entails and how long you can expect to invest in each one in order to build good credit.

1. Review Your Credit Reports

Estimated time: 1-3 hours

In order to improve your credit score, it is important to understand what factors may be positively or negatively affecting it. One way to gain this insight is by reviewing your credit history.

To get started, obtain a copy of your credit report from each of the three major national credit bureaus: Equifax, Experian, and TransUnion. After receiving these reports, take the time to review each one carefully. Pay attention to the information that may be contributing to a higher credit score, such as a history of on-time payments, low balances on your credit cards, a mix of different credit card and loan accounts, older credit accounts, and minimal inquiries for new credit.

On the other hand, there are also factors that may be detracting from your credit score. These may include late or missed payments, high credit card balances, collections, and judgments. By understanding both the positive and negative factors that affect your credit score, you can begin to take steps towards improving it.

2. Join a Credit Builder Program

Estimated Time: 15-20 Minutes

For those with limited credit history, credit builder programs are a powerful ally. I highly recommend KOVO Credit Building. Kovo offers a unique approach to financing that differs from traditional loans. Instead of borrowing money and making repayments over an extended period, you can purchase access to Kovo’s carefully selected courses. This access can be paid off over a 24-month period, providing a flexible and effective way to access the educational content you need.

These courses include:

- Job Interview Skills, Interview Strategy & Answer Scripts

- Self Confidence & Self Esteem: Confidence via Self-Awareness

- Entrepreneurship: How To Start A Business From Business idea

- Personal Branding Path To Top 1% Influencer Personal Brand

- Stress Management With Time Management For Burnout & Anxiety

- Entrepreneurship: Sales Training, Techniques and Methods

- Ecommerce Bootcamp Academy

- Google Sheets Fundamentals

- Intro to Programming

- Financial Literacy

- Empowering Your Credit Journey

3. Pay down your Credit Balances

Estimated Time: 1-3 Months

Paying more than your minimum payment each month is a smart move if you have the extra funds. By doing so, you can gradually reduce your revolving debt, which can significantly improve your credit score. The rate at which your score improves depends on how quickly your creditors report the paid balance on your credit report. The reporting frequency varies among creditors, with some reporting within days of payment and others reporting at a specific time each month. To find out when your card issuer reports balances to the bureaus, you can call or chat with them online.

It’s best to pay off your balance as soon as possible each month. You can also make multiple payments throughout the month to keep track of your spending and maintain a low balance. While paying off a portion of your debt is helpful, paying off the entire balance will have the greatest and quickest impact on your credit score.

4. Request a credit limit increase

Estimated Time: 1-3 Hours

An effective method of reducing your credit utilization ratio, especially if you are carrying high balances, is to increase your credit limits.

For example, if you owe $700 on a card with a $1,000 credit limit, your credit utilization ratio is 70%. However, if you manage to increase your credit limit to $2,000, your ratio will drop to 35%. Some credit issuers offer the option to request a credit limit increase via their online account services. Citi, for instance, allows cardholders to submit such requests on their “Credit Card Services” page.

Alternatively, you can call the number on the back of your card to make the request. Keep in mind that some issuers may conduct a hard credit inquiry before granting you a higher credit line, which can temporarily lower your credit score.

However, your score will eventually recover. If you are unsure of how your request will be handled, ask the issuer for details before proceeding. It is important to note that if you have a history of late payments, carry high balances, or have only had the card for a short period of time, your request may be denied until you are perceived as a less risky customer.

5. Apply for a new credit card

Estimated Time: 1-3 Hours

One way to decrease your credit utilization ratio is to apply for a new credit card. This is because the addition of a new credit line increases the total credit available to you. This can be particularly helpful if you’re unable to pay off your existing credit card debt quickly.

However, before you apply for a new credit card, it’s important to consider a few factors:

Firstly, determine the type of credit card that suits your needs. If your credit score is poor or fair, you should look into a secured credit card that is designed to help you establish a good credit history. Such cards require a deposit that is equal to your credit limit and protect the issuer if you default on the debt. Conversely, if you have good credit or better, you may want to apply for a card that offers rewards or an introductory APR period.

Secondly, it’s worth checking if you prequalify for any credit cards. Certain issuers, including American Express, Capital One, Chase, and Discover, allow consumers to check if they prequalify. While prequalification doesn’t guarantee approval, it does improve your chances of being approved when you actually apply.

How to dispute credit errors on your file

To rectify any mistakes on your credit report, it is recommended that you dispute the errors with each credit bureau involved. This can be accomplished by submitting a written explanation of the inaccuracies, along with any supporting documentation, and utilizing the credit bureau’s dispute form, if available.

Be sure to keep a record of all correspondence and documentation submitted. If mailing your dispute, use the address provided on your credit report or the credit bureau’s designated address for disputes.

Final Thoughts:

Having a good credit score is a worthwhile objective, particularly if you are considering applying for a substantial loan to buy a new house or vehicle or want to be eligible for the best rewards credit cards out there.

It may take a few weeks or even a few months before you start to see a significant improvement in your score after you start taking measures to turn it around.

In some cases, you may need the assistance of one of the top credit repair firms to erase some of the bad marks.

Nevertheless, the sooner you begin working to enhance your credit, the faster you can get your finances back on track!