Crypto traders of the world are constantly seeking innovative ways to gain an edge in the highly volatile market. One such groundbreaking tool that has captured the attention of both novice and seasoned investors alike is the use of cryptocurrency trading bots.

These automated software programs, designed to buy and sell cryptocurrencies at optimal times, promise to revolutionize the way we engage with digital assets.

But what exactly are these bots, and how can one leverage them to maximize returns while minimizing risks?

Let’s dive in

What is a Crypto Trading Bot?

Trading bots are like computer programs. They take in information and rules to make trades. Just like a trader might want to buy something when it’s cheap, bots can be programmed to do the same. These rules can get pretty complicated, using technical analysis like looking at prices, trading volume, and chart patterns.

But to follow these rules, bots need to get data about cryptocurrency prices and use digital charts. They do this using something called Application Programming Interfaces (APIs), which connect different software. APIs help bots quickly gather lots of data from places like exchanges.

And once they have all the data, bots make trades based on the rules they’ve been given. They can buy and sell on exchanges without any human help.

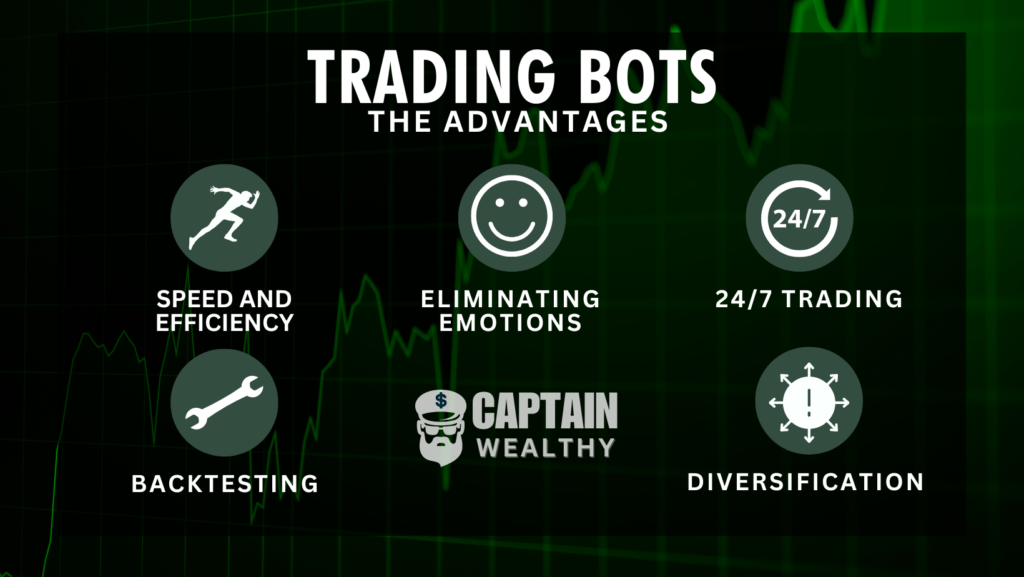

Advantages of Cryptocurrency Trading Bots

24/7 Trading: Trading bots operate round the clock, allowing traders to capitalize on market opportunities even when they are asleep or away from their screens.

Speed and Efficiency: Bots can execute trades at lightning-fast speeds, reacting to market movements in real-time and minimizing latency associated with manual trading.

Elimination of Emotions: Emotions such as fear and greed can often cloud judgment in trading decisions. Trading bots operate based on predefined rules and algorithms, eliminating emotional biases and ensuring disciplined execution of trades.

Diversification: Bots can simultaneously execute trades across multiple cryptocurrency pairs and exchanges, enabling traders to diversify their portfolios and mitigate risk.

Backtesting and Optimization: Many trading bots offer backtesting capabilities, allowing traders to test their strategies on historical data to assess performance and refine their approaches before deploying them in live markets.

Criteria for Selecting the Best Crypto Trading Bots

When evaluating and researching crypto trading bots, several key factors come into play:

Performance: Assess the bot’s track record and performance metrics, including profitability, win rate, and drawdowns.

Functionality: Consider the range of features offered, including trading strategies, customization options, and compatibility with exchanges.

Security: Security is paramount in the crypto space. Ensure that the bot offers robust security measures to safeguard your funds and personal information.

User Experience: A user-friendly interface and intuitive controls can enhance the trading experience, especially for novice users.

Customer Support: Reliable customer support is essential for resolving issues promptly and ensuring a smooth user experience.

Top Crypto Trading Bots in the Market

Here are the top 3 crypto trading bots (free and paid) that I have extensively researched for you.

Let’s get into it.

1.CoinRule

Coinrule is an automated trading platform designed for cryptocurrency traders. It allows users to create and execute trading strategies without the need for coding skills. With its user-friendly interface, traders can easily set up rule-based strategies based on technical indicators, market conditions, and price levels.

Pros

- No trading fees (charges a flat monthly rate)

- Free account to paper trade, backtest and make a limited amount of trades

- Doesn’t access private keys

- Mobile app for on-the-go trading

Cons

- Trades only on centralized exchanges

- No connections with Gemini

4.5/5

My Personal Opinion: Great tool. You can design your own rules to trade crypto without being a coder. So you can DCA or buy the dip, grid trading, or trend following, whatever is your style and depending on market conditions. They already have a large set of crypto trading rules templates but you can be creative and develop your own rules. It is very intuitive. The community and Coinrule support are very active on telegram.

2. CryptoHopper

Cryptohopper is a cryptocurrency trading bot that allows users to automate their trading strategies across various exchanges. It offers features such as algorithmic trading, backtesting, and the ability to follow and copy the strategies of other successful traders. Users can customize their trading bots according to their preferences and risk tolerance, making it accessible for both novice and experienced traders in the cryptocurrency market.

Pros

- Copy and social trading are available

- Beginner-friendly interface

- Affordable starting price with free plan

- Many features to customize

- Mobile app for on-the-go trading

- Works with 16 cryptocurrency exchanges

- Tools for testing and monitoring

- Mobile apps for iOS and Android

Cons

- Subscription fees for advanced features

5/5

My Personal Opinion: I’m absolutely loving this bot—I’ve given others a shot, but none compare. Once you wrap your head around the templates, strategies, and signals, it leaves the competition in the dust. The interface is top-notch, making trading across all my exchanges as simple as pushing a button. My results so far? Pretty darn good. And let me tell you, the customer service? Exceptional. I reached out for help using their chat feature twice in the past two days as I was getting started, and both times I was connected with a live person (shoutout to Rodrigo) within minutes. He knows the product inside out and helped me get everything set up smoothly. I’d wholeheartedly recommend it.

3. Pionex: Best FREE Trading Bot

Pionex makes cryptocurrency trading easy by eliminating the need for API Keys. With 18 free cryptocurrency bots available, including Pionex Grid Trading Bot, Pionex Leveraged Grid Bot, and Pionex Margin Grid Bot, there is something for everyone.

Other bots like the Reverse Grid Bot, Leveraged Reverse Grid Bot, Dollar-Cost Averaging Bot, TWAP Bot, Trailing Take Profit Bot, BTC Moon, ETH Moon, and Spot-Futures Arbitrage Bot are also available. Pionex is a top-rated platform for cryptocurrency trading, offering free trading bots since 2017. It aggregates liquidity from exchanges such as Binance.com and Huobi, making it even better.

Additionally, Pionex offers options trading products like Lottery, where you can start investing with as little as $1.

Pros

- Manual trading with limit and market orders available

- Automated trading with 16 free bots

- Extremely low trading fees of only 0.05%

- Android and iOS mobile apps available

- Tutorials to explain how to use each trading bot

Cons

- The free and regular plans of Pionex offer fewer features than their competitors

- No demo account

- No telephone contact number

- No support for custom trading strategies

4/5

My Personal Opinion: Although I don’t have any major issues with the platform’s stability and performance with my bots and trades, I did encounter some inconveniences while using Pionex. Specifically, I found their wallet maintenance to be disorganized and unclear. When attempting to withdraw my assets using ERC20, I discovered that it was undergoing maintenance without any indication of when it would be back up. Despite reaching out to their support team, I received a vague response stating that they would notify me when it was available again. In my opinion, this lack of transparency and planning is not a good business practice. It’s important for companies to have a clear strategy in place before performing any maintenance to avoid causing frustration and confusion for their users.

Final Thoughts on Cryptocurrency Trading Bots

Cryptocurrency trading bots have revolutionized the way traders engage with the crypto markets, offering automation, efficiency, and precision in trading operations.

By understanding the functionalities and advantages of trading bots and carefully evaluating factors such as functionality, performance, security, user experience, and customer support, traders can select the most suitable bot to optimize their trading strategies and navigate the dynamic world of cryptocurrencies with confidence and success.