Predicting the future in Crypto world can feel like trying to catch a falling star. However, experts in blockchain technology and digital assets have weighed in with their insights on what may lie ahead in 2025. In this article, we will explore the latest crypto predictions for the next five years and provide a glimpse into what the future of this transformative industry might hold.

From increased mainstream adoption to advancements in blockchain technology, these predictions paint a picture of a thriving ecosystem that continues to redefine the way we do business and exchange value. Whether it’s the rise of decentralized finance (DeFi), the integration of cryptocurrencies into everyday transactions, or the emergence of new use cases for blockchain, the potential for growth and innovation seems limitless.

By analyzing the perspectives of industry thought leaders, we’ll uncover trends and developments that could shape the crypto landscape in the years to come. Join us as we dive into the expert insights and explore the exciting possibilities that await us in the world of blockchain technology and digital assets.

Get ready to envision the future of crypto in 2025 and beyond.

Understanding the Current State of the Crypto Market

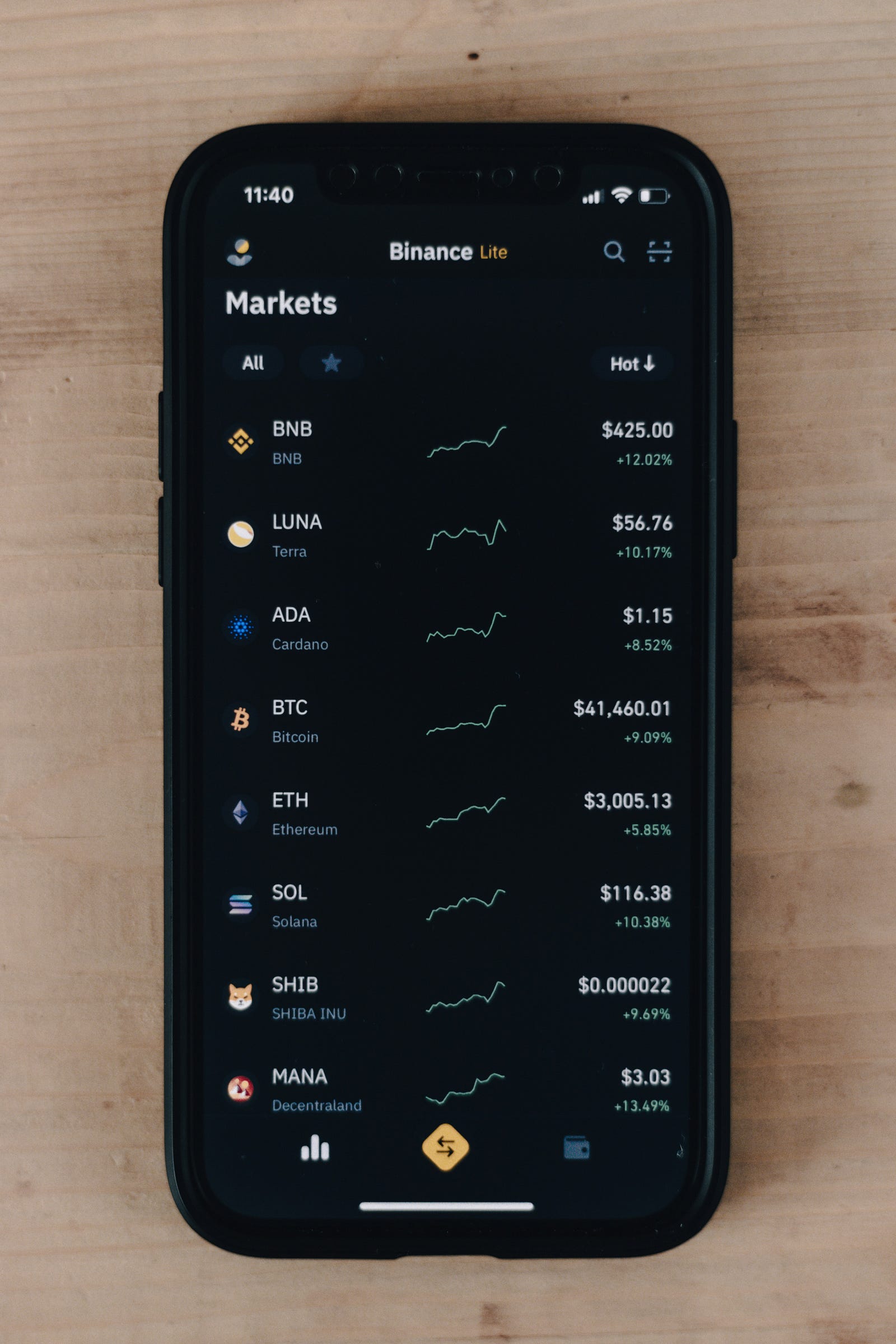

The crypto market has come a long way since the inception of Bitcoin in 2009. Today, it is a multi-trillion-dollar industry that has attracted the attention of investors, entrepreneurs, and governments alike. The current state of the crypto market can be characterized by its volatility, rapid innovation, and growing acceptance.

One of the key factors driving the growth of the crypto market is increased mainstream adoption. As more individuals and businesses recognize the benefits of cryptocurrencies, we are witnessing a shift towards digital assets as a store of value and a medium of exchange. Major companies like PayPal and Tesla have embraced cryptocurrencies, further legitimizing their use in everyday transactions. This trend is expected to continue in the coming years, driving further growth and acceptance of digital assets.

However, the crypto market is not without its challenges. Volatility remains a key concern, with prices of cryptocurrencies often experiencing significant fluctuations. Additionally, regulatory uncertainty and security risks continue to impact the industry. As the crypto market matures, it is expected that these challenges will be addressed, leading to a more stable and secure environment for investors and users alike.

Factors Influencing the Future of Blockchain Technology

Blockchain technology, the underlying technology behind cryptocurrencies, has the potential to revolutionize various industries beyond finance. As we look towards the future of blockchain technology, several factors are expected to influence its growth and development.

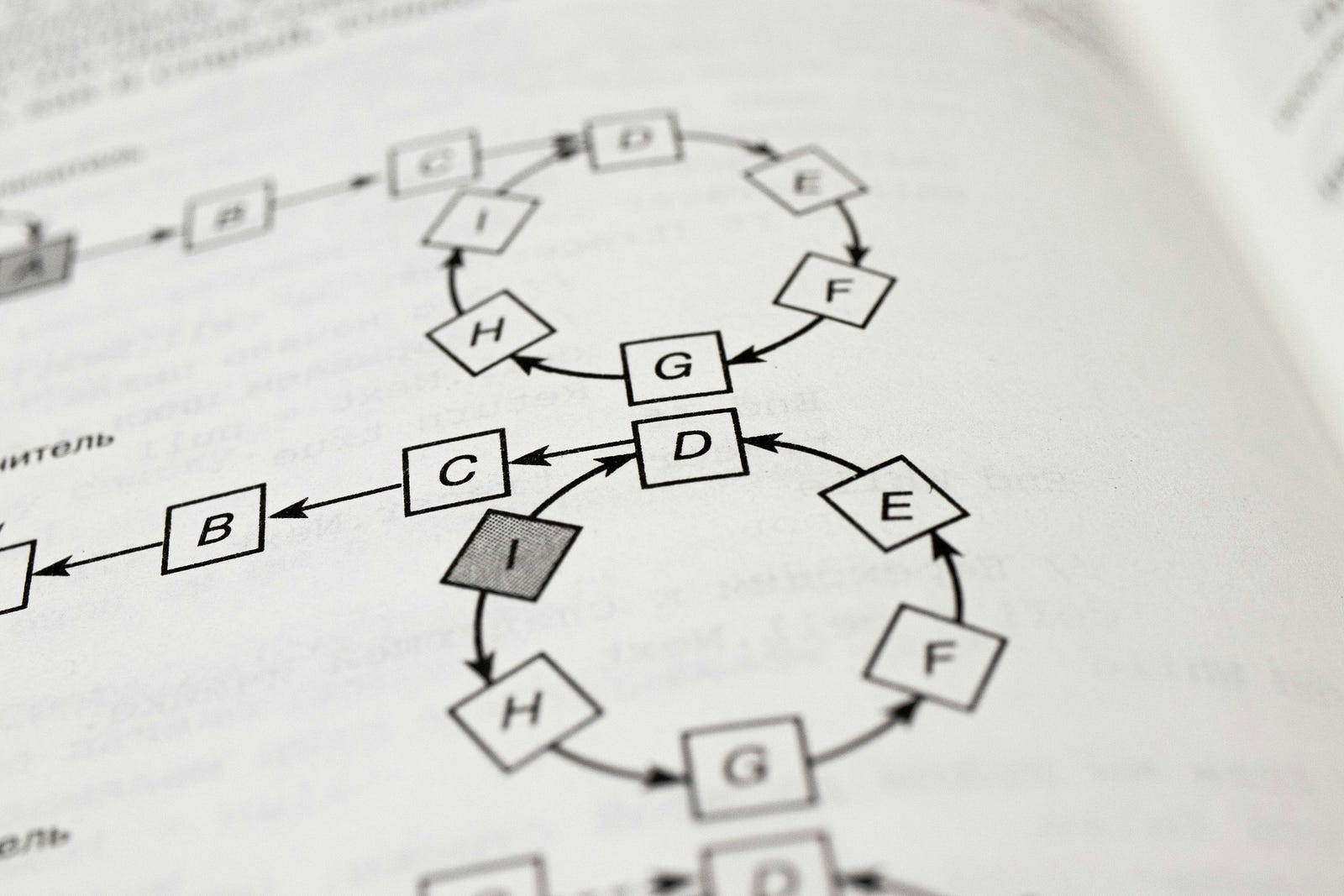

One of the key factors is scalability. The current limitations of blockchain, such as slow transaction speeds and high fees, have hindered its widespread adoption. However, there are ongoing efforts to address these scalability issues through the development of layer-two solutions and the implementation of new consensus algorithms. These advancements could pave the way for blockchain to handle a higher volume of transactions and support more complex applications.

Another factor shaping the future of blockchain technology is interoperability. Currently, there are numerous blockchain networks that operate in isolation, limiting their ability to communicate and interact with each other. However, projects like Polkadot and Cosmos are working on creating interoperability protocols that would enable different blockchains to seamlessly exchange data and assets. This interoperability could unlock new possibilities for collaboration and innovation across different industries.

The integration of blockchain with other emerging technologies is also expected to play a significant role in shaping its future. For example, the combination of blockchain and artificial intelligence (AI) could enable the creation of decentralized autonomous organizations (DAOs) that are governed by smart contracts and AI algorithms. Similarly, the integration of blockchain with the Internet of Things (IoT) could facilitate secure and transparent data exchange between connected devices. These synergies between blockchain and other technologies could drive further innovation and adoption in the coming years.

Expert Predictions for the Growth and Development of Cryptocurrencies

As the crypto market continues to evolve, experts have made various predictions about its growth and development in the next five years. These predictions provide insights into the potential opportunities and challenges that lie ahead.

One of the key predictions is the continued rise of decentralized finance (DeFi). DeFi refers to the use of blockchain technology to recreate traditional financial systems in a decentralized manner. Experts believe that DeFi will continue to gain traction, offering individuals greater access to financial services and disrupting traditional intermediaries. This could include decentralized lending and borrowing platforms, decentralized exchanges, and decentralized stablecoins.

Another prediction is the integration of cryptocurrencies into everyday transactions. As more merchants and service providers accept cryptocurrencies as a form of payment, the use of digital assets for everyday purchases could become more commonplace. This could include anything from buying groceries to paying for a cup of coffee using cryptocurrencies. The integration of cryptocurrencies into mainstream payment systems could further drive adoption and acceptance.

Experts also predict the emergence of new use cases for blockchain technology. While cryptocurrencies have been the primary focus of the crypto market, blockchain has the potential to revolutionize various industries beyond finance. This could include applications in supply chain management, healthcare, voting systems, and more. As more industries recognize the value of blockchain, we can expect to see a wide range of innovative use cases emerge in the coming years.

The Potential Impact of Regulatory Frameworks on the Crypto Industry

Regulatory frameworks play a crucial role in shaping the crypto industry. While some countries have embraced cryptocurrencies and blockchain technology, others have taken a more cautious approach. The regulatory landscape can have a significant impact on the growth and development of the crypto market.

One potential impact of regulatory frameworks is increased investor protection. Regulations can help establish clear guidelines for investors, reducing the risk of fraud and ensuring that market participants operate in a transparent and accountable manner. This increased investor protection could attract more institutional investors to the crypto market, driving further growth and stability.

However, overly restrictive regulations could stifle innovation and hinder the growth of the crypto industry. It is crucial for regulatory frameworks to strike a balance between protecting investors and fostering innovation. Countries that adopt a progressive regulatory approach, striking this balance, are likely to attract blockchain startups and entrepreneurs, becoming hubs for innovation and development.

Innovations in Blockchain Technology That Could Shape the Future

Blockchain technology is constantly evolving, with new innovations and developments emerging regularly. These innovations have the potential to shape the future of blockchain and drive further adoption.

One such innovation is the development of privacy-enhancing technologies for blockchain. While blockchain is known for its transparency, privacy is also an important consideration in many use cases. Projects like Monero and Zcash are working on creating privacy-focused cryptocurrencies that allow users to transact anonymously. These privacy-enhancing technologies could open up new possibilities for blockchain applications in areas such as healthcare and finance.

Another innovation is the development of energy-efficient consensus algorithms. The current consensus algorithm used by Bitcoin, known as proof-of-work, requires significant computational power and energy consumption. However, alternative consensus algorithms like proof-of-stake and proof-of-authority are gaining traction for their energy efficiency. These energy-efficient consensus algorithms could address concerns about the environmental impact of blockchain technology and make it more sustainable in the long run.

The integration of blockchain with other emerging technologies is also driving innovation. For example, the combination of blockchain and artificial intelligence (AI) can enable the creation of smart contracts that can execute based on real-time data and AI algorithms. This could automate various processes and reduce the need for intermediaries. Similarly, the integration of blockchain with the Internet of Things (IoT) can facilitate secure and transparent data exchange between connected devices, enabling new applications in areas such as supply chain management and smart cities.

The Role of Institutional Investors in the Crypto Market

Institutional investors, such as hedge funds, asset management firms, and pension funds, have traditionally been cautious when it comes to investing in cryptocurrencies. However, there is growing interest and participation from institutional investors in the crypto market, which could have a significant impact on its growth and stability.

One of the key drivers of institutional investment in cryptocurrencies is the potential for high returns. As the crypto market continues to mature, institutional investors are recognizing the opportunities for profit and portfolio diversification that digital assets offer. This increased interest from institutional investors could lead to greater liquidity and stability in the market.

Institutional investors also bring a level of credibility and expertise to the crypto market. Their involvement can help establish best practices and standards, fostering trust among retail investors and regulators. Additionally, institutional investors often have access to significant capital, which can be used to fund blockchain startups and projects, driving further innovation and development.

However, the entry of institutional investors into the crypto market also presents challenges. Institutional investors typically have strict regulatory and compliance requirements, which could impact the flexibility and anonymity that cryptocurrencies offer. Striking a balance between meeting regulatory requirements and preserving the core principles of cryptocurrencies will be crucial to ensure the continued growth and development of the crypto market.

Potential Challenges and Risks in the Crypto Space

While the crypto market holds tremendous potential, it is not without its challenges and risks. Understanding and mitigating these challenges is essential for individuals and businesses looking to navigate the evolving landscape of digital assets.

One of the key challenges is regulatory uncertainty. The lack of a consistent regulatory framework across different jurisdictions creates uncertainty for market participants and may hinder the growth of the crypto industry. It is essential for regulators to provide clear guidelines and regulations that strike a balance between protecting investors and fostering innovation.

Security risks are also a significant concern in the crypto space. While blockchain technology itself is secure, the surrounding infrastructure, such as cryptocurrency exchanges and wallets, can be vulnerable to hacks and cyberattacks. It is crucial for individuals and businesses to adopt best practices for securing their digital assets, such as using hardware wallets and implementing multi-factor authentication.

Volatility is another challenge in the crypto market. Prices of cryptocurrencies can experience significant fluctuations, creating both opportunities and risks for investors. It is important for individuals to have a clear understanding of the risks involved and to invest responsibly.

How to Navigate the Evolving Landscape of Digital Assets

Navigating the evolving landscape of digital assets requires a combination of knowledge, research, and caution. Here are some tips to help individuals and businesses navigate the crypto market:

- Educate Yourself: Take the time to understand the fundamentals of blockchain technology, cryptocurrencies, and the risks involved. Stay up to date with the latest developments and trends in the crypto market.

- Do Your Research: Before investing in any digital asset, conduct thorough research. Evaluate the project’s team, technology, use case, and potential for long-term growth. Consider factors such as market demand, competition, and regulatory environment.

- Diversify Your Portfolio: Spread your investments across different cryptocurrencies and projects to mitigate risk. Diversification can help protect your portfolio from the volatility of individual assets.

- Secure Your Digital Assets: Use hardware wallets or secure software wallets to store your digital assets. Implement best practices for securing your wallets, such as using strong passwords, enabling two-factor authentication, and keeping your private keys offline.

- Invest Responsibly: Only invest what you can afford to lose. The crypto market can be highly volatile, and prices can fluctuate rapidly. Set realistic expectations and avoid making impulsive investment decisions based on short-term market movements.

- Stay Informed: Stay updated with the latest news and developments in the crypto market. Subscribe to reputable cryptocurrency news platforms and follow industry influencers for insights and analysis.

Wrapping Up

As we look towards the future of blockchain technology and digital assets in 2025, the potential for growth and innovation seems limitless. From increased mainstream adoption to advancements in blockchain technology, the crypto market is poised for further development and disruption.

By understanding the current state of the crypto market, the factors influencing the future of blockchain technology, and the predictions made by industry experts, individuals and businesses can navigate the evolving landscape of digital assets with confidence. While challenges and risks exist, embracing the opportunities presented by blockchain technology can lead to transformative changes in various industries and shape the future of finance and beyond.

So, get ready to embark on this exciting journey into the future of crypto in 2025 and beyond. The possibilities are endless, and the rewards await those who are willing to embrace the transformative power of blockchain technology and digital assets.