Trading legends are not just successful investors; they are the embodiment of brilliance, foresight, and a deep understanding of financial markets. These remarkable individuals have achieved extraordinary success, leaving an indelible mark on the world of trading.

In this article, we will delve into the lives and strategies of the greatest investors of all time, uncovering the secrets behind their legendary status.

Who are Trading Legends?

Trading legends are investors who have demonstrated exceptional skill in financial markets, amassing vast fortunes and earning widespread admiration. Their journeys are marked by overcoming challenges, taking bold risks, and achieving monumental successes.

By studying their stories, aspiring traders can gain valuable insights and inspiration to navigate the complex world of investing.

Warren Buffett: The Oracle of Omaha

No list of trading legends would be complete without Warren Buffett, the Chairman and CEO of Berkshire Hathaway.

With his patient and value-based investing approach, he has earned the moniker “The Oracle of Omaha.” Buffett’s success lies in his ability to identify undervalued companies and hold onto his investments for the long term, a strategy that has made him one of the wealthiest individuals globally.

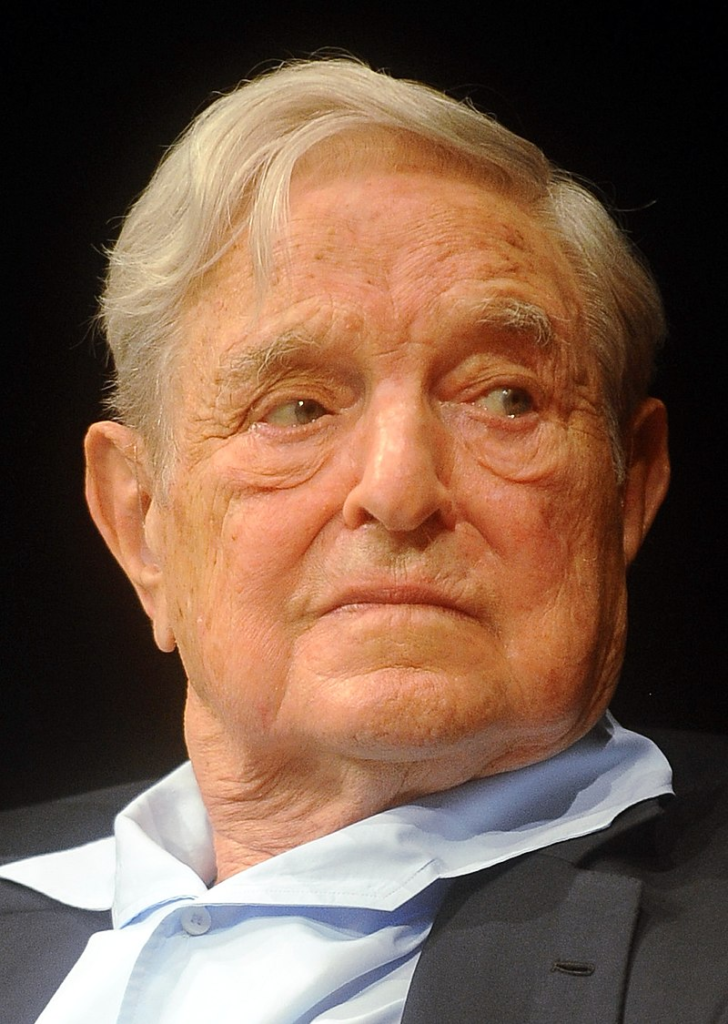

George Soros: The Man Who Broke the Bank of England

George Soros, a Hungarian-American investor, gained notoriety for his legendary trade against the British pound in 1992.

His massive bet against the pound earned him a profit of over $1 billion and earned him the title “The Man Who Broke the Bank of England.” Soros’s approach involves speculating on macroeconomic trends and capitalizing on market inefficiencies.

Jesse Livermore: The Boy Plunger

Jesse Livermore, often referred to as “The Boy Plunger,” was a legendary stock trader in the early 20th century. He was known for his exceptional timing and skill in short-selling during market downturns.

Livermore’s experiences and lessons are chronicled in his book “Reminiscences of a Stock Operator,” which remains a classic among traders.

Peter Lynch: The Legendary Fund Manager

Peter Lynch is renowned for his role as the portfolio manager of Fidelity Magellan Fund, where he achieved outstanding returns for over a decade.

His philosophy of investing in what he understood and believed in, coined as “invest in what you know,” helped him uncover hidden gems and deliver extraordinary results.

Paul Tudor Jones: The Robin Hood of Traders

Paul Tudor Jones earned fame as “The Robin Hood of Traders” when he predicted the 1987 stock market crash and protected his clients’ capital from significant losses.

His macro trading strategies and ability to read market sentiment have made him a legendary figure in the financial world.

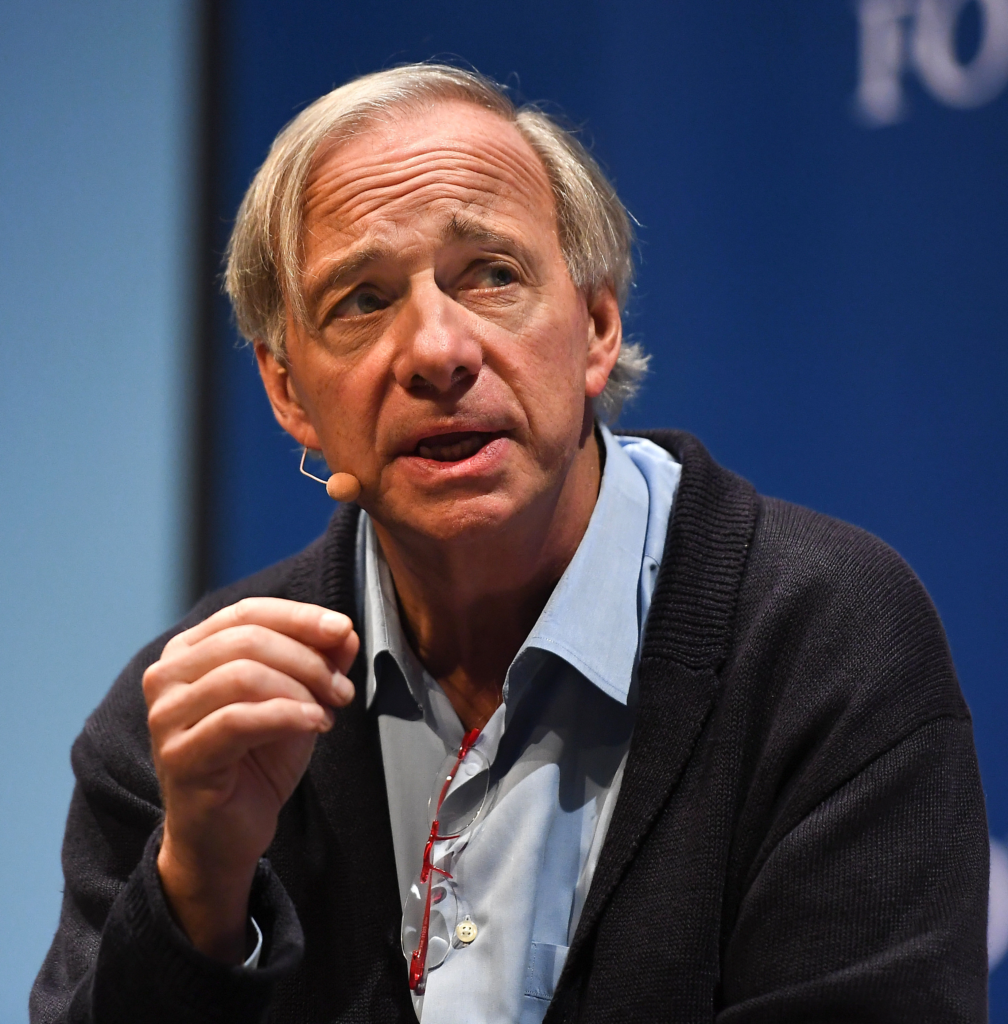

Ray Dalio: The Hedge Fund Guru

Ray Dalio, the founder of Bridgewater Associates, is one of the most successful hedge fund managers in history.

His principles of “radical transparency” and “thoughtful disagreement” have shaped Bridgewater’s culture and investment approach, contributing to its remarkable track record.

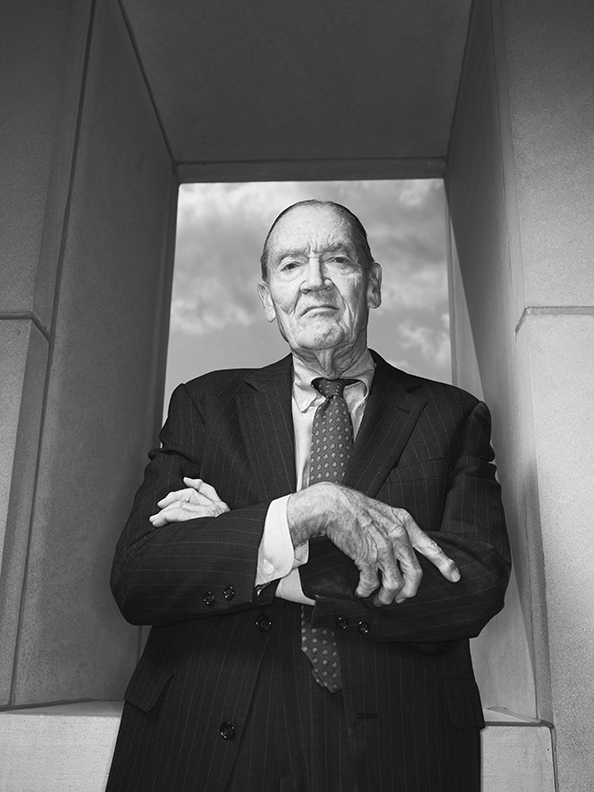

Jack Bogle: The Father of Index Investing

Jack Bogle revolutionized investing with the creation of the first index mutual fund and the founding of Vanguard Group.

His belief in low-cost, passive investing has empowered countless individuals to build wealth through the stock market.

Kathy Lien: The Queen of the Currency Market

Kathy Lien, a highly respected currency strategist, is known as “The Queen of the Currency Market.”

Her expertise in forex trading and macroeconomic analysis has made her a leading figure in the forex community.

Stanley Druckenmiller: The Billion-Dollar Trader

Stanley Druckenmiller is celebrated for his successful trades, including the famous bet against the British pound alongside George Soros.

His macro trading style and ability to capitalize on global economic trends have cemented his status as a trading legend.

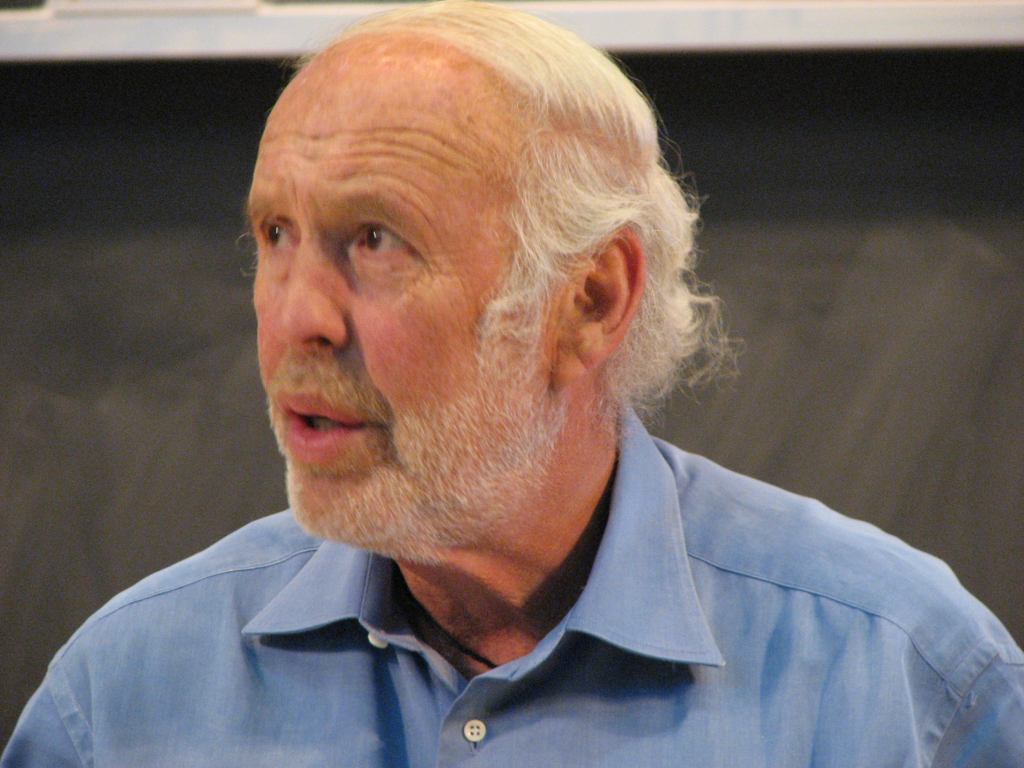

Jim Simons: The Quantitative Investing Pioneer

Jim Simons, a former mathematician and founder of Renaissance Technologies, revolutionized investing with his quantitative trading strategies.

Under his leadership, Renaissance Technologies achieved remarkable returns using complex mathematical models.

What Makes Them Legendary?

While each trading legend has a unique approach and style, several common traits underpin their success.

Patience, discipline, a strong understanding of the market, and the ability to adapt to changing conditions are characteristics shared by these legends.

Lessons from the Trading Legends

Studying the strategies and experiences of trading legends can offer valuable lessons for investors.

Key takeaways include the importance of research, risk management, emotional resilience, and a commitment to continuous learning.

Wrapping it Up

Trading legends are a source of inspiration and knowledge for investors seeking to achieve greatness in the world of finance. By studying their stories and strategies, aspiring traders can gain valuable insights to enhance their own investment journeys.

Embrace the lessons imparted by these legends and embark on a path of success in the dynamic and exciting world of trading.

Frequently Asked Questions

While it’s essential to learn from their approaches, it’s crucial to tailor strategies to your risk tolerance and financial goals.

Trading legends understand that losses are a natural part of trading. They maintain emotional resilience and learn from every trade.

Absolutely! Many trading principles employed by legends can be adapted and utilized by individual investors for success.

No, you can start with a smaller capital and grow your portfolio over time by employing disciplined and strategic approaches.

It varies for each legend, but their journeys typically involve years of dedication, learning, and adapting to market conditions.