When it comes to fueling your small business’s growth, equity financing can be a game-changer. Unlike traditional loans, which saddle you with debt, equity financing involves trading ownership stakes for capital injections.

This can be an attractive option for startups or businesses looking to expand without the burden of repayment.

What is Equity Financing?

Equity financing allows businesses to raise funds by selling shares of the company to investors. These investors become partial owners and share in the company’s profits and losses.

Types of Equity Financing

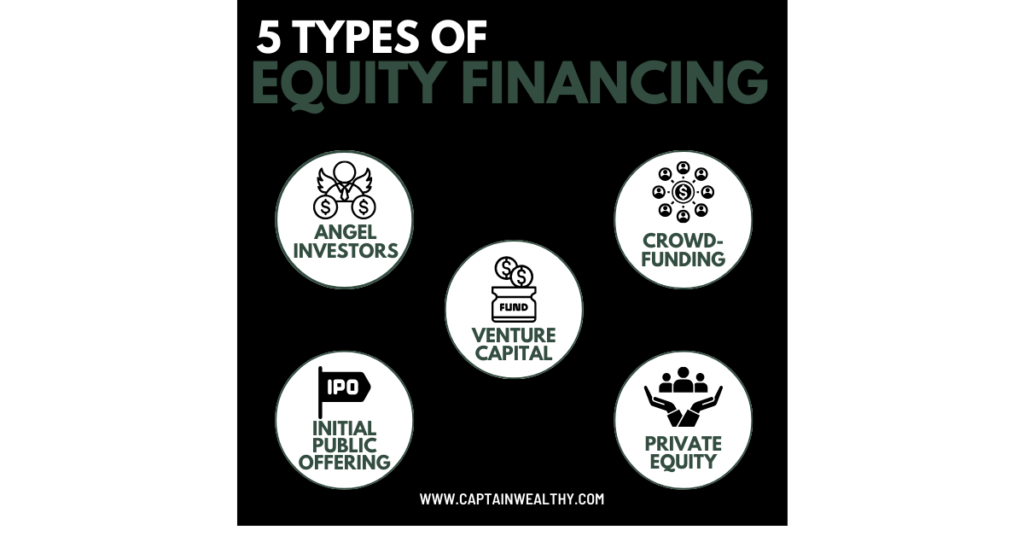

There are various types of equity financing available:

Angel Investors: These are individuals who invest their personal funds into startups or early-stage companies in exchange for ownership equity.

Venture Capital: Funds are provided by venture capital firms to startups and small businesses with high growth potential in exchange for equity ownership.

Private Equity: Investments made by private equity firms into established companies with the goal of restructuring or expanding, often involving substantial amounts of money.

Crowdfunding: This involves raising small amounts of money from a large number of people through online platforms in exchange for equity or other rewards.

Initial Public Offering (IPO): This process involves offering shares of a private corporation to the public in a new stock issuance, marking the transition from private to public ownership.

These types of equity financing options differ in terms of the business stage they target, the investment amount, and the expectations of both the investor and the business seeking funding.

Pros and Cons of Equity Financing

Before diving in, let’s weigh the pros and cons of equity financing:

Pros

- Access to Capital

- No Repayment

- Mentorship

- Shared Risk

- Potential for Growth

- Flexibility

Cons

- Can be complex

- Requires hard work

Is Equity Financing Right for You?

Deciding on equity financing for your business involves these key steps:

Firstly, evaluate if trading ownership shares for capital aligns with your long-term goals and growth plans. This affects your control and profit sharing with investors.

Understand the risks of equity financing—giving up ownership and sharing profits—which may not suit every business model.

Assess your business’s growth potential to see if equity financing, appealing to high-return investors, can accelerate your growth.

Compare equity financing with other funding options like loans to find what suits your financial needs and strategic goals.

Ensure your business is legally and financially prepared with solid structures and records for investor expectations.

Building strong relationships with investors is crucial, providing more than just funding—strategic insights and mentorship.

Plan your exit strategy, ensuring readiness to manage shares or exit partnerships if circumstances change.

By weighing these factors carefully, you can decide if equity financing is the right choice for your business goals and success.

Alternatives to Equity Financing

If equity financing isn’t a perfect fit, explore other options:

– Debt Financing: Traditional loans that must be repaid with interest.

– Grants and Subsidies: Non-repayable funds often provided for specific purposes.

How to Get Started with Equity Financing

Embarking on equity financing can significantly boost your small business’s growth potential by injecting capital without the burden of debt repayment. Unlike traditional loans, equity financing involves selling shares of your company to investors who, in turn, become stakeholders in your business.

This not only provides financial support but also brings strategic expertise and valuable networks that can accelerate your business’s development.

Step 1: Assess Your Business Readiness

Before pursuing equity financing, it’s essential to evaluate your business’s readiness. Begin by developing a comprehensive business plan that outlines your market position, growth projections, and financial health. This plan serves as a roadmap for potential investors, showcasing your vision and demonstrating how their investment will fuel your business’s expansion.

Additionally, determine a realistic valuation of your company. Knowing your worth is crucial when negotiating equity stakes with investors. Ensure your legal and operational structures are in order to facilitate smooth transactions and comply with investor expectations.

Step 2: Research and Identify Potential Investors

Once you’re confident in your business’s readiness, the next step is to identify and approach potential investors. Networking plays a pivotal role here—tap into your professional network, attend industry events, and explore online platforms dedicated to connecting businesses with investors.

Platforms like EquityNet provide a valuable resource for finding investors interested in your industry. Creating a compelling business profile on EquityNet can enhance your visibility and attract potential backers.

Step 3: Craft a Compelling Pitch

Investors receive numerous proposals, so crafting a compelling pitch is essential to capture their interest. Your pitch should go beyond financial projections—it should tell a compelling story about your business’s unique value proposition, market opportunity, and potential for growth.

Prepare a detailed pitch deck that outlines your business model, competitive advantage, target market, and financial projections. Highlight what sets your business apart and why investors should partner with you for mutual success.

Step 4: Negotiate Terms and Close the Deal

When you’ve garnered investor interest, negotiate the terms of the investment. Review and discuss the term sheet, which outlines the conditions, expectations, and obligations of both parties. It’s advisable to seek legal counsel to ensure the terms are fair and protect your interests throughout the process.

Maintain open communication with potential investors, addressing any concerns they may have and clarifying your business strategy and growth plans. Building trust and transparency is crucial for fostering a successful partnership.

Step 5: Utilize EquityNet’s Free Business Profile Feature

As you navigate the equity financing process, consider leveraging EquityNet’s free business profile feature. This platform allows you to create a detailed profile showcasing your business’s strengths, financial metrics, and growth potential. Investors actively search platforms like EquityNet for investment opportunities, making it a powerful tool to increase your visibility and attract potential backers.

By following these steps and leveraging tools like EquityNet, you can effectively navigate the complexities of equity financing and position your business for accelerated growth. Each stage—from assessment to negotiation—plays a crucial role in securing the right investors and forging a path towards long-term success.

My 7 Tips for Successful Fundraising

Interested in using equity financing to boost your business? Here are seven tips drawn from my personal experience and insights:

- Shape Your Business Story: When pitching to investors, go beyond numbers—share your passion and the journey that led to your business. Explain why your idea is important and how it solves real-world problems. A compelling story resonates deeply and sets you apart from other entrepreneurs.

- Research Your Potential Investors: Not all investors have the same interests. Research diligently to find investors who not only have the money but also share your business values and goals. Look into their past investments and successes to see if they align with your vision.

- Highlight Your Dream Team: Investors invest in people as much as they do in ideas. Showcase your team members’ strengths and experiences. Demonstrate how their skills complement your vision and why they are essential to your business’s success.

- Embrace Transparency: Be open about your business journey—both the victories and the challenges. Transparency builds trust and credibility. Address any concerns upfront and show your ability to learn and grow from setbacks.

- Show Market Traction: Prove to investors that your business is gaining momentum. Share significant milestones, customer feedback, and growth metrics. Concrete evidence of market demand and growth potential strengthens your case for investment.

- Be Choosy yet Persistent: Finding the right investor is like finding a business partner. Be selective in choosing investors who not only bring money but also offer expertise and connections. At the same time, persistence pays off—building relationships takes time, so stay committed to your search.

- Safeguard Your Vision: Negotiating terms can be intimidating, but it’s essential to protect your business’s future. Seek legal advice to ensure the terms are fair and in line with your long-term goals. Balance securing funding with maintaining control over your business’s direction.

These tips reflect my journey through equity financing. Apply them thoughtfully to approach investors confidently, attract the right partnerships, and pave the way for your business’s growth and success.

Wrapping it Up

equity financing presents small businesses with a robust path for growth and expansion. By trading ownership shares for capital, entrepreneurs can fuel their ventures without accumulating debt. This strategy not only secures financial resources but also attracts valuable partnerships and guidance from committed investors.

Ultimately, the suitability of equity financing hinges on the business’s objectives, stage of development, and financial readiness. Embracing equity financing strategically can unlock transformative opportunities, empowering small businesses to achieve unprecedented success and innovation in their respective industries.

Frequently Asked Questions

What is equity financing?

Equity financing involves raising capital for your business by selling shares to investors in exchange for ownership stakes.

How does equity financing differ from taking a loan?

Unlike loans, where you borrow money and repay it with interest, equity financing does not involve debt. Instead, investors become partial owners of your business.

Who typically invests in equity financing?

Investors in equity financing can include angel investors, venture capitalists, and private equity firms who seek high growth potential and a stake in promising businesses.

What are the advantages of equity financing?

Equity financing provides access to capital without incurring debt, brings strategic expertise from investors, and shares business risks with stakeholders.

What are the risks of equity financing?

Risks include dilution of ownership as you sell shares, potential loss of control as investors may influence business decisions, and the high expectations for returns on investment.