As an avid investor, I know the importance of making informed decisions when it comes to buying and selling stocks.

One way to gain an edge in the stock market is by subscribing to a stock picking service.

These services provide investors with expert insights and recommendations on which stocks to buy, sell, or hold.

However, with so many options available, it can be challenging to choose the right one. In this article, I will discuss the top-rated stock picking services and provide criteria for evaluating them.

When evaluating stock picking services, it’s essential to consider factors such as the service’s track record, the expertise of its analysts, the frequency of its recommendations, and the types of stocks it covers.

By analyzing these factors, investors can make informed decisions about which service is right for them. Additionally, it’s crucial to consider the fees associated with these services, as they can vary widely. Some services charge a flat fee, while others charge a percentage of assets under management.

Criteria for Evaluating Stock Picking Services

As an avid investor, I have evaluated several stock picking services over the years. Based on my experience, I have identified four key criteria that are essential in evaluating the effectiveness of a stock picking service.

Performance Track Record

The most crucial factor in evaluating a stock picking service is its performance track record. A reliable service should have a proven track record of consistently providing profitable stock picks over a sustained period. It is essential to look beyond the overall returns and analyze the service’s performance during market downturns and volatility. A reliable service should be able to provide profitable stock picks, even in challenging market conditions.

Expertise of Analysts

The expertise of analysts is another critical factor in evaluating a stock picking service. The service should have a team of experienced analysts with a deep understanding of the stock market. The analysts should have a strong track record of accurately predicting market trends and identifying profitable investment opportunities. It is also essential to ensure that the analysts have relevant qualifications, such as a CFA (Chartered Financial Analyst) certification.

Service Transparency

A reliable stock picking service should be transparent in its operations. The service should provide clear and concise information about its investment strategies, stock selection criteria, and performance track record. It is also essential to ensure that the service provides regular updates on its portfolio and investment decisions. Transparency is crucial in building trust and confidence in the service.

Cost vs Value

The cost of a stock picking service is an important consideration, but it should not be the sole factor in evaluating the service’s effectiveness. It is essential to evaluate the service’s cost against its value proposition. A service that charges a higher fee but provides a proven track record of profitable stock picks and expert analysis may be more valuable than a cheaper service that does not provide the same level of expertise and performance.

In conclusion, evaluating a stock picking service requires a thorough analysis of several factors, including performance track record, expertise of analysts, service transparency, and cost vs value. By considering these factors, investors can make informed decisions when selecting a stock picking service that aligns with their investment goals and objectives.

Top Rated Stock Picking Services

As an experienced investor, I have come across several stock picking services that have proven to be effective in identifying profitable investment opportunities.

In this section, I will discuss some of the top-rated stock picking services that I have personally used and found to be reliable.

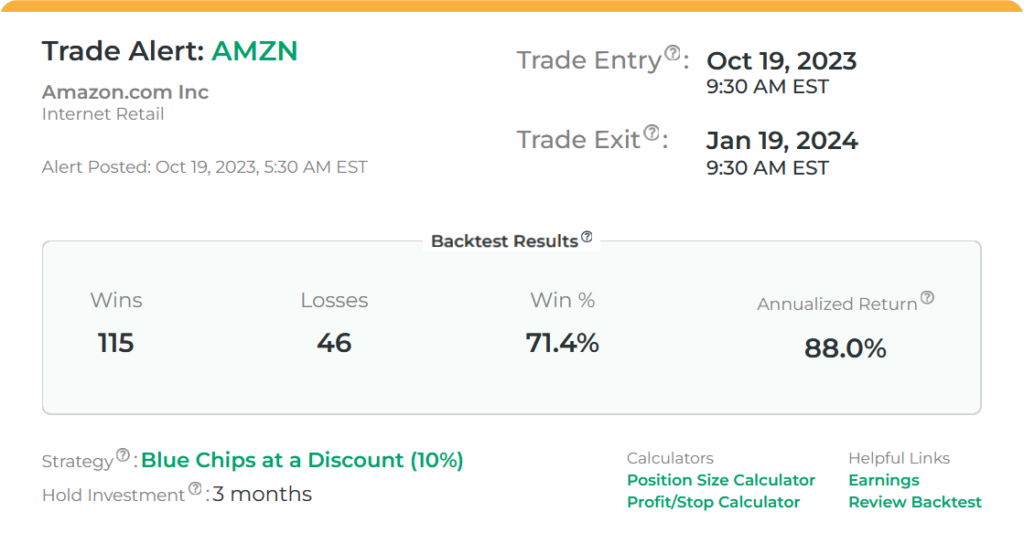

1. Stock Market Guides – My Favorite

When I first started out with investing, I came across Stock Market Guides. It proved to be an incredibly valuable resource for stock picking.

Their approach combines in-depth research with clear, actionable advice, making it easier for me to navigate the complexities of the stock market. What sets them apart is their focus on educating investors—each recommendation is accompanied by a thorough analysis that helps me understand the rationale behind their picks. This transparency builds trust, and I’ve seen positive results in my portfolio since following their recommendations.

Whether you’re a novice or seasoned investor, Stock Market Guides offers a well-rounded service that empowers you to make informed decisions confidently

Benefits of Using Stock Picking Services

As someone who invests in stocks, I have found that using a stock picking service can be incredibly beneficial. These services provide a range of advantages that can help you make more informed investment decisions and ultimately increase your returns. Here are some of the key benefits of using stock picking services:

Time Savings

One of the main benefits of using a stock picking service is the time savings it provides. Instead of spending hours researching individual stocks and analyzing market trends, you can rely on the expertise of the service’s analysts. This frees up time to focus on other aspects of your life, such as your career or personal hobbies.

Educational Resources

Many stock picking services also provide educational resources to help you become a more knowledgeable investor. These resources can include articles, webinars, and even one-on-one coaching sessions with experienced analysts. By learning more about the stock market and investment strategies, you can make more informed decisions and increase your chances of success.

Investment Diversification

Another benefit of using a stock picking service is the ability to diversify your investments. These services typically provide recommendations for a range of stocks across different sectors and industries, which can help reduce your risk exposure. By investing in a diversified portfolio, you can increase your chances of generating consistent returns over the long term.

Overall, using a stock picking service can be a smart investment for anyone looking to improve their investment strategy. By saving time, accessing educational resources, and diversifying your portfolio, you can increase your chances of success in the stock market.

Considerations Before Subscribing

Investment Goals Alignment

Before subscribing to any stock picking service, it is important to ensure that the service aligns with your investment goals. Consider factors such as the service’s investment approach, the types of stocks recommended, and the service’s historical performance. It is also important to determine whether the service’s investment goals align with your own goals. For example, if you are a long-term investor, you may want to consider a service that focuses on stocks with strong fundamentals and a history of steady growth.

Risk Tolerance

Another important consideration is your risk tolerance. Some stock picking services may recommend high-risk, high-reward stocks, while others may focus on more conservative investments. It is important to determine your own risk tolerance and ensure that the service you choose aligns with your risk profile. If you are a conservative investor, you may want to consider a service that focuses on blue-chip stocks with a history of stable returns.

Portfolio Size

Finally, it is important to consider your portfolio size when choosing a stock picking service. Some services may be better suited for larger portfolios, while others may be more appropriate for smaller portfolios. It is also important to consider the cost of the service and whether it is affordable for your portfolio size. Some services may offer discounts for larger portfolios, while others may offer a flat fee regardless of portfolio size.

Wrapping it Up

Overall, it is important to carefully consider your investment goals, risk tolerance, and portfolio size before subscribing to any stock picking service. By doing so, you can ensure that you choose a service that is aligned with your needs and can help you achieve your investment goals.

Frequently Asked Questions

What are the most reliable stock picking services for beginners?

As a beginner, it is important to choose a stock picking service that is easy to use, has a proven track record, and provides educational resources. Based on my research, Stock market guides and Alpha Picks are great options for beginners. Both services have a user-friendly interface, educational resources, and a track record of success.

Which stock picking service is best for day trading performance?

Day trading requires real-time alerts and trading signals. While many stock picking services offer these features, it is important to choose a service that is reliable and accurate. Ticker Nerd and Moby are two services that are known for their real-time alerts and trading signals. However, it is important to remember that day trading is risky and requires a lot of knowledge and experience.

How do stock picking services benefit long-term investors?

Stock picking services can benefit long-term investors by providing research and analysis on potential investments. By using a stock picking service, investors can save time and make more informed decisions. Additionally, some services offer portfolio management tools that can help investors track their investments and make adjustments as needed.

Can you trust free stock picking services to provide valuable insights?

While there are some free stock picking services that provide valuable insights, it is important to be cautious. Free services may not have the same level of research and analysis as paid services, and their recommendations may not be as reliable. It is important to do your own research and use multiple sources when making investment decisions.

What are the characteristics of a highly accurate stock picker?

A highly accurate stock picker is someone who has a deep understanding of the market and the ability to identify undervalued stocks. They also have a proven track record of success and use a consistent methodology for selecting stocks. Additionally, they are transparent about their investment strategy and provide regular updates and analysis.