Building credit can be challenging, especially if you’re starting with a limited or less-than-perfect credit history.

In this article, I will provide an in-depth review of Kovo Credit Builder

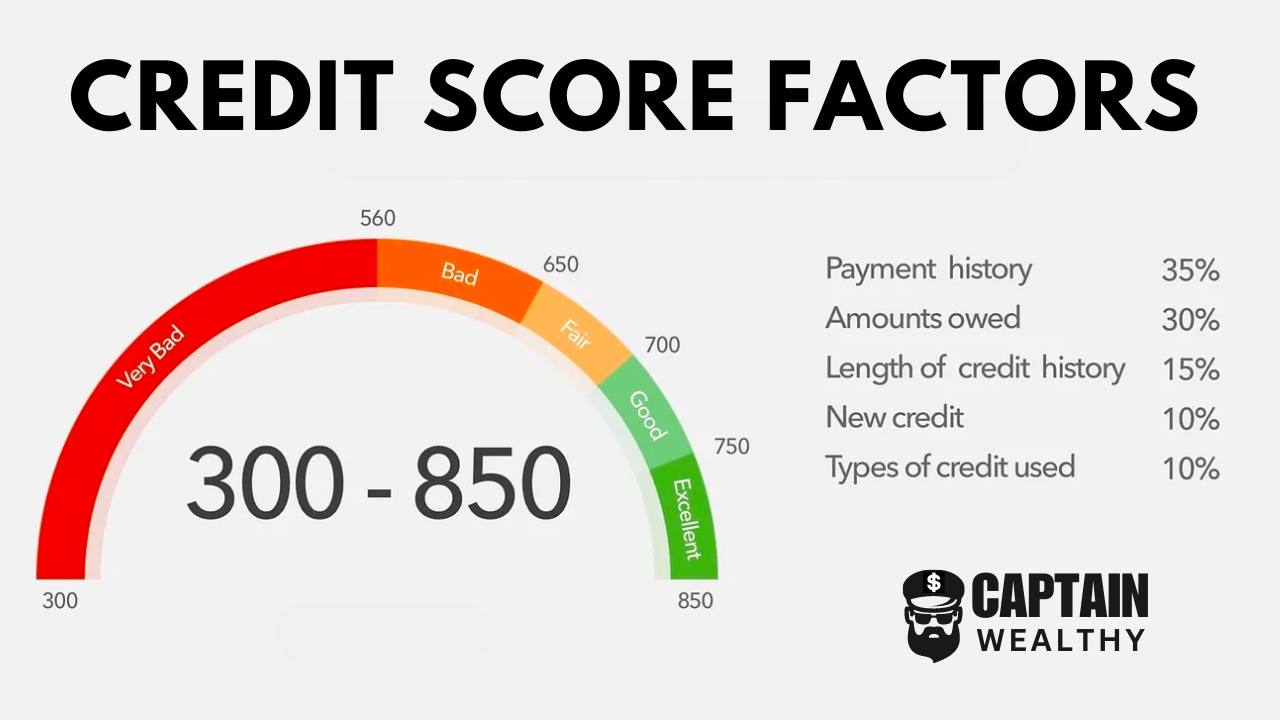

Understanding the Importance of Credit Building

Before diving into Kovo Credit Builder, it’s essential to understand why building and maintaining a good credit score matters.

A strong credit profile opens doors to better financial opportunities, such as lower interest rates on loans, higher credit limits, and approval for various financial products.

How Kovo Helps Build Your Credit

Kovo offers a unique approach to financing that differs from traditional loans. Instead of borrowing money and making repayments over an extended period, you can purchase access to Kovo’s carefully selected courses. This access can be paid off over a 24-month period, providing a flexible and effective way to access the educational content you need.

These courses include:

- Job Interview Skills, Interview Strategy & Answer Scripts

- Self Confidence & Self Esteem: Confidence via Self-Awareness

- Entrepreneurship: How To Start A Business From Business idea

- Personal Branding Path To Top 1% Influencer Personal Brand

- Stress Management With Time Management For Burnout & Anxiety

- Entrepreneurship: Sales Training, Techniques and Methods

- Ecommerce Bootcamp Academy

- Google Sheets Fundamentals

- Intro to Programming

More information and access to their site can be found here!

Kovo Pricing

It’s true that nothing in life is free, and Kovo’s courses are no exception. However, customers who purchase access to these courses are buying them on credit, with the promise of valuable knowledge and skills. Although Kovo claims that the courses are worth over $400, they offer them to customers for $240.

To make the courses more accessible, Kovo allows customers to pay off the cost of the courses over a period of 24 months, with monthly installments of $10. These payments are reported to credit bureaus such as TransUnion, Experian, Equifax, and Innovis, helping customers to build their credit scores over time.

Unlike other loans and lines of credit, Kovo’s credit builder program does not carry an Annual Percentage Rate (APR) and there are no monthly or annual fees. Additionally, there are no penalties for paying off the loan early, and no late fees for missed payments. Overall, Kovo offers an affordable and flexible way to access valuable educational resources while building your credit.

Pros and Cons of Kovo Credit Building

Here are the Pros and Cons of Kovo Credit Building:

Pros

- No credit check is required

- Access to tons of educational courses

- Reports to all 4 credit bureaus

- Real credit score improvement

Cons

- No phone app available

More information and access to their site can be found here!

The Verdict: Is Kovo Credit Builder Worth It?

In weighing the pros and cons, Kovo Credit Builder proved to be a valuable tool in anyone’s credit-building journey. The platform’s user-friendly approach, coupled with educational resources and personalized recommendations, made a positive impact on my credit score.

While it’s essential to continue financial discipline and responsible credit management, Kovo Credit Builder provides a solid foundation for credit improvement.

I encourage anyone looking to enhance their credit health to explore the Kovo Credit Builder, while also implementing wise financial habits.

More information and access to their site can be found here!

Frequently Asked Questions (FAQs)

1. How long does it take to see improvements in credit scores with Kovo Credit Builder? Kovo Credit Builder’s impact on credit scores can vary depending on individual credit histories and financial habits. Some users may notice improvements within the first month, while others may take longer.

2. Can Kovo Credit Builder guarantee specific credit score increases? While Kovo Credit Builder provides effective credit-building strategies, it cannot guarantee specific credit score increases. Credit scores are influenced by various factors, and individual results may vary.

3. Does using Kovo Credit Builder affect my credit negatively? No, using Kovo Credit Builder does not negatively impact your credit. The service is designed to help improve your credit score through responsible credit-building practices.

4. Can I cancel my Kovo Credit Builder subscription at any time? Customers can cancel at any time within the first 30 days.

5. Is Kovo Credit Builder suitable for individuals with no credit history? Yes, Kovo Credit Builder is an excellent option for individuals with limited or no credit history, as it offers tailored credit-building solutions.